By Anton Evstratov

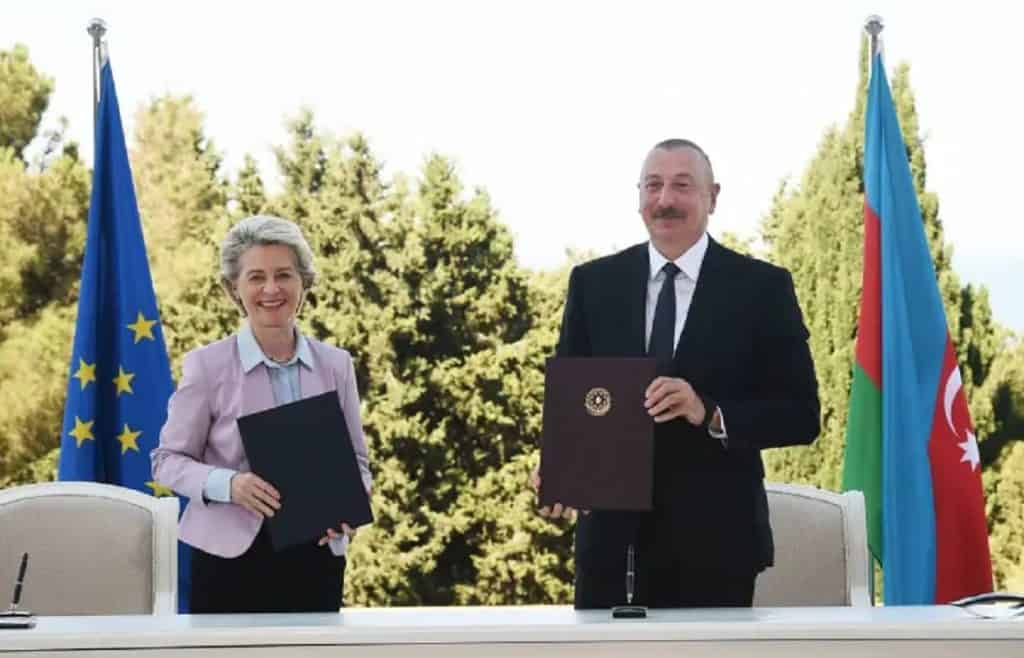

The “gas memorandum” signed between the EU and Azerbaijan opens up new prospects for regional policy.

The agreement provides for a doubling of Azerbaijani gas supplies to Europe until 2027. Thus, by that time the Old World is expected to receive at least 20 billion cubic meters of gas from Azerbaijan via the TANAP gas pipeline – via Turkey. At the same time, the supply volume is expected to grow from 8.5 to 12 billion cubic meters by 2023. In this way, the European Union seeks to diversify gas dependence on Russia as much as possible in the context of the Ukrainian crisis and the tougher confrontation between Western countries and Moscow.

First of all, and in the short term, the measure is more of a political nature, since the EU needs at least 500 billion cubic meters of gas, 40% of which has so far been covered by Russia. Even if all of the memorandum’s targets are met, it will be an extremely minor factor in achieving European energy security. Nevertheless, on the one hand, the Azerbaijani supplies should be perceived not only on their own, but also in combination with other alternative Russian sources of fuel – Algerian and Qatari, and as an important step towards the integration of Azerbaijan and further – Central Asian states in the energy projects of the EU with the corresponding political dividends for both sides.

In addition to the agreement with Azerbaijan, European diplomacy is also successfully conducting other negotiations. In particular, Italian Prime Minister Mario Draghi agreed on gas supplies to the country from Algeria in the volume of about 20 billion cubic meters this year (with slightly less than 14 billion already supplied to the country). German Chancellor Olaf Scholz met with Egyptian President Abdel Fattah el-Sisi, who expressed his intention to deepen energy cooperation with Germany. French President Emmanuel Macron, for his part, met with his UAE counterpart Muhammad bin Zayed Al Nahyan and also agreed to deepen energy cooperation.

There are already questions about Azerbaijan’s ability to double its gas production. Moreover, to pump this amount of fuel to Europe it is necessary to modernize the Azerbaijani gas pipeline infrastructure. However, the latter problem can be solved – for this solution the EU has promised to invest 250 million dollars. However, the second issue is directly linked with the first one.

Theoretically, Azerbaijan can significantly increase gas production, but this will require additional time, funds and a lot of technical effort. At the same time, a number of Central Asian states have long been interested in supplying their gas to Europe through the Azerbaijani pipeline. First of all, it is Turkmenistan. Azerbaijani and Turkmen speakers, often at a quite high level, have repeatedly expressed the intention to ensure the transit of Turkmen gas through Azerbaijan and then Turkey to Europe. However, Turkey has recently expressed a considerable degree of interest in this issue. Back in June, the relevant statement was made by the country’s vice-president Fuad Oktay, who named three options for delivering Turkmen gas to Azerbaijan, from where it could arrive via TANAP.

First, we are talking about the construction of a trans-Caspian pipeline, secondly, about increasing swap supplies through Iran, and thirdly, about a combination of the pipeline and oil carriers.

Turkmenistan, Azerbaijan, Turkey and the EU are all interested in getting Turkmen gas to Azerbaijan – and this interest has been there for a long time.

In 1999, a project for the construction of a trans-Caspian gas pipeline by the consortium of Shell, Bechtel and GE was presented, but it temporarily ceased to be relevant due to the discovery of significant gas reserves in Azerbaijan, capable of satisfying the demand of neighboring Georgia and Turkey, and even some EU countries.

At present, the situation is changing dramatically, but to the previously existing obstacles to the implementation of the gas pipeline project across the Caspian Sea is added a number of new ones – first of all, this is the position of Russia, seeking to prevent even minor competition to its gas from the Central Asian, as well as the current status of the Caspian Sea, which does not allow the construction of such an infrastructure without the consent of all the Caspian countries. Given that Russia and Iran are guaranteed to oppose the initiative, one can characterize the likelihood of its implementation as mythical.

For the same reason, as well as the high cost of the project, it does not make sense to seriously consider the combination of ships and the short pipeline that Oktay spoke of.

Swap supplies look more interesting, when Turkmen gas is first supplied to Iran, and then the Iranian fuel goes to Azerbaijan in the same amount. However, there are two obstacles here. Firstly, Iran is subject to sanctions and in general has an anti-Western stance in its foreign policy. This vector may become especially acute after Tehran’s rapprochement with Moscow and the latter’s promised investment in the Iranian economy. Secondly, even in case of the most favorable political and technical developments (serious modernization of the existing pipeline capacities between Iran and Azerbaijan) the volume of the supplied Turkmen gas will hardly exceed 2.5-3 billion cubic meters a year, which does not cover the existing deficit. In addition, if Russia feels even hypothetical competition from Turkmen gas, it is unlikely to be difficult to convince the Iranian side to abandon the expansion of swap projects with Azerbaijan and Turkmenistan.

In this regard, a number of experts non-publicly express the idea that de facto Russian gas can flow to Europe through Azerbaijan. Under the guise of Azerbaijani gas, the EU will not impose sanctions on it, and countries such as Bulgaria and Northern Macedonia will be able to meet their needs (through the TAP gas pipeline). At the same time, the traditional consumers of Azerbaijani gas – Georgia and Turkey – will not be deprived of it. Russia, in turn, will compensate for its losses through Nord Stream and some of the sanctions damage.

It is believed that this possibility explains the loyalty of the Russian side to Azerbaijan and Turkey in regional processes, particularly in the Armenian-Azerbaijani settlement. For example, Moscow never expressed any attitude to the permanent Azerbaijani shelling of Armenian territory, allowed the Azerbaijani Armed Forces to occupy the village of Parukh in Artsakh, and did not respond to the destruction of monuments to Soviet generals in the territories of Nagorno-Karabakh. Instead, the Russian foreign minister visited Baku, and Russian tourists, despite isolated incidents, continue to go to Turkish resorts.

Considering that so far Azerbaijan, which signed an alliance declaration with Russia on the eve of the start of the Ukrainian special operation, has never shown itself as a Russian ally, we can assume that the meaning of the said document was primarily in this gas castling. Indirect evidence of the correctness of this assumption can serve as a share of Russian companies in the Azerbaijani oil and gas sector. In particular, the Shah Deniz field in the Caspian Sea is 10% owned by Russian Lukoil, which has already become a reason for criticism of this deal by a number of European politicians, experts and public figures.

An important factor in this criticism was the fact that the EU signed an agreement with Baku without setting any preconditions for the Aliyev regime to carry out reforms in this area, given the overwhelming evidence of human rights violations and repressions on Azerbaijan’s territory.

However, for Russia this kind of game is profitable only in the short term, because in the long term it can be simply forced out of the oil and gas projects in the region. Azerbaijan and Turkey will get a developed gas pipeline network and the opportunity to export unprecedented amounts of gas to Europe, and the Russian fuel in the future and with a change in the geopolitical structure can be replaced by Azerbaijani, Turkmen or (in the long term vision) Kazakh. This will also lead to political losses for Moscow, the place of which will finally be taken by Turkey, as well as the EU states standing behind it and dependent on it and Azerbaijan. Undoubtedly, at the moment it is not foreseen – Russia controls regional processes and this control will become more successful after inclusion of Iran on the Russian side, but this kind of game requires from Russia a high degree of professionalism and significant political capital, which may not always be present. In light of the above, Rosneft’s latest investment contract with Iran’s NIOC worth tens of billions of dollars is noteworthy.

Considering that after the nuclear agreement Iran must re-enter the world oil market, the Russian oil giant will prove to be an integral part of these processes. If Russia’s energy isolation by the West continues and Moscow directs its resources to Asian markets, it will remain an important actor in the European supply chain through Iran and Azerbaijan.

Author: Anton Evstratov (Russian historian, publicist and journalist living in Armenia, lecturer at the Department of World History and Foreign Regional Studies at the Russian-Armenian University in Yerevan).

(The views expressed in this article belong only to the author and do not necessarily reflect the views of World Geostrategic Insights).