The future is the projection of the present son of the past. Any event of the human life, even the most unthinkable one, is originated by a cause/concomitant cause; nothing happens by chance, but any action is a continuation of a sequence of events.

Ukraine’s invasion was predictable since Russia annexed Crimea, although it was an objective based on an outdated vision and therefore not winning. Hamas attack on Israel was likely. As admitted by the Israeli prominent figures, the intelligence reports have been neglected; but it can’t be excluded that the signals have been ignored by purpose to have a reason to invade the territories and destroy Hamas’ extremists. Sometimes reality prevails over imagination.

Is World War III foreseeable? Yes and no. Yes, if the projection of the future refers to the past, especially the Thirties years of last century. No, if the paradigm changes in terms of the expected objectives, which are no longer the annexation of territories, but the conquest of markets. In the past, territories were conquered to expand the markets, nowadays markets are conquered to govern territories.

The conventional wars are already a reality because of the many conflicts going on in the Planet. Much more important are the trade wars, which are fought in every region of the world and particularly in Africa. How will the Continent react facing economic crisis, poverty and inequality?

It can be observed that despite the progress achieved to bridge the poverty gap the problem remains and, what’s more, it got worse. Currently, poor people aren’t only those living with US$ 2/d (UN definition) but also those who haven’t access to finance for a better living or start-up & growth-up business.

In this perception, the narrative of the facts is crucial. We do say that what has been narrated doesn’t entirely reflect reality, having been written by the same Actors who caused the failures.

ANALYSIS

The extent to which the reasoning is shared, the first step is to redraft the socio-economic-financial narrative and this the purpose of this contribution. Basically, it is a matter of recovering the ability to project the future avoiding the past mistakes; in a nutshell, there is a need to get back into the game. Here we try to do it.

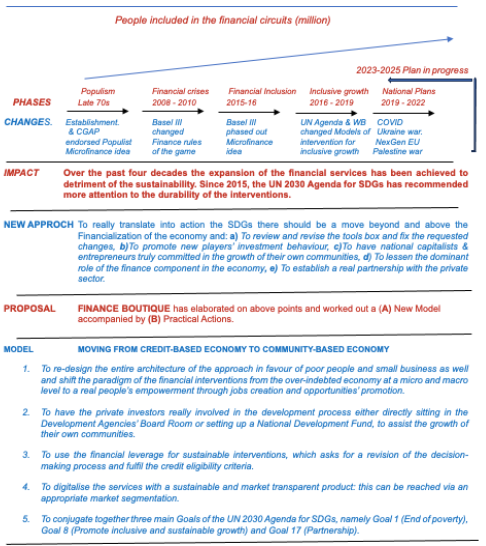

The below Figure visualises the trend of the past four decades, which has been worked out referring to the Development Actors’ behaviour, who acted in the picture of the dominant economic theory, namely the financial capitalism.

The 80/90s years of the last century the central position of the financial component produced inequality and therefore it is very important to propose an alternative model of development.

If we want to change the course of action, we have to rewrite the current homologated storyline. As a matter of fact, the poverty mission should be reconsidered in terms of sustainable growth and the transformation of economies because the current interventions have not reached the target, due to a series of failures and, among others:

– The ineffective governments’ interventions to fight poverty.

– The dominant role of finance in the economy (financialization) to the detriment of the real economy.

– An uncontrolled credit market due to the lack of an institutional framework at national level.

– The greedy newcomers without experience in the credit profession.

– A large potential of demand deemed profitable for unscrupulous traders.

From the figure we can also learn the rise and fall of the Populist Movement. Last century the Populists launched the microfinance idea on the assumption that it was the correct way to fight poverty. Both desk research and field activities proved that it has been a wrong approach. Moreover, the Populists have been wrong about the modalities to make inclusion happens and indeed they:

– assigned to the lender the task to fight poverty, which is a GVT duty and responsibility,

– mystified the concept of credit that means confidence and, more important,

– neglected to inform that credit must be managed by Professionals.

In this context, unskilled and questionable finance providers along with low profile politicians entered the market wiping out the difference among Lenders, Developers and Philanthropists.

At that time, the financial establishment and the media supported and inflated the Microfinance Movement before evidence. This happened because the Governments did fail to alleviate poverty, despite the billions of hard currencies injected in the field; it was considered important to go via credit, the move being in line with the dominant role of the financial component of the economy.

Figure – Connecting the dots of the financial narrative

Eventually, the scenario has been redefined following the recommendations released in 2010 by Basel III Committee: “Microfinance Activity and the Core Principles for Effective Banking Supervision”, http://www.bis.org/publ/bcbs175.pdf, which marked a demarcation line with the past. Since then, the document has been a reference point to regulate the uncontrolled microfinance market that encompasses hundreds of finance providers.

Currently, what does the microfinance market look like? From field research carried out in 2022 https://nextbillion.net/yes-microcredit-requires-subsidies-and-thats-great-news/, we quote: “While more than two-thirds of MFIs show an accounting profit, less than 20 percent show an economic profit. In other words, only those 20 percent are truly sustainable. The other 80 percent could not maintain their current operations without social investors providing below market-rate capital. And it’s not a question of subsidising the new MFIs who are scaling up. Three-quarters of subsidy in the industry flows to MFIs which are 10 years old or older”.

We don’t share the idea that micro-credit requires subsidy because it could mean going back to three decades of past mistakes, besides being not in line with SDGs.

After that, between end 2015 and beginning 2016, the Establishment made a further step phasing out microfinance idea proposed by the Populists, with the release of a Basel III Document on financial inclusion (https://www.bis.org) and a CGAP Paper on market system approach to financial inclusion (http://www.cgap.org/publications/new-funder-guidelines-market-systems-approach-financial-inclusion).

Both Document and Paper gained a wide consensus from Academics to Practitioners who endorsed the idea to have the countries’ development via inclusive growth that really empower people and promote start-up and growth-up business and every Actor is committed under the flag of Private & Public Partnership.

People’s dissatisfaction has found echo with the Big Finance Players and concrete discussions went on. On the matter we may refer to the World Bank annual meetings (October 2018): “The World Bank Group faces the difficult task of positioning itself at the forefront of the world’s most urgent challenges, while also navigating politically charged issues that could divide its largest shareholders”.

The EU Commission shared the same position and stated, “complex challenges in the world are around us – ranging from poverty conflicts and migration to climate-change and demographic challenges”.

Summing up, capitalism won single battles but lost the war against poverty. So, if we want to change the course of action, we have to rewrite the current homologated storyline.

FINDINGS

In the above scenario the expected performance of whatsoever activity in any of the three segments (Enterprise Development, Income Generating Activities, Food aid) shall vary in relation of the relative importance (weight) of the interests, objectives, positions, expectations of the players and as a result the search of a welding point shall be found out in a continuing negotiation: “The factors affecting the Projects performance” https://ascaniograziosi.net/2018/08/13/the-factors-affecting-the-projects-performance/.

The financial leverage is important, sometimes vital, and its sustainable use creates jobs and promotes opportunities, the government providing an enabling environment. With a salary people may or may not apply for a loan and buy a mobile phone; in doing so the meaning of credit – confidence – will be re-established.

In this understanding we have elaborated a Model to put finance providers in the picture of the guidelines provided by the international financial establishment, to facilitate the access of the entrepreneurs to the source of capital.

We proposed four steps to design a new Credit Model:

1 Position the MFI/Organisation in the financial market

2) Place the Business in the picture of the country institutional & organisational framework

3) Design a credit model/service within the regulatory framework, as per Basel III document

4) Find out the market’s niche via the proposed market segmentation.

Source: FINANCIAL INCLUSION, Give people a job not a loan, https://itunes.apple.com/us/book/id1116912686.

– The digitalisation of the financial services

In the wave of digitization, the proposed steps are of utmost importance because the question isn’t to provide people with a smart mobile phone or WhatsApp, but to have people eligible for its use. There are two ways to understand digitalization: product innovation and process innovation. The former when we simply provide the client with an electronic device, the latter when the electronic device adds value to the service and creates opportunities.

We found out that there is the risk that credit history could repeat itself with failures and bankrupts: everybody is rushing to provide people with a WhatsApp. Why? 1) Because it is a lucrative business, but it could be short-sighted; 2) The imitation factor: everybody does it; 3) The misunderstanding between means and objectives: financial inclusion isn’t the objective to achieve but a means to get countries’ inclusive growth within UN 2030 Agenda for SDGs. And Much more.

RECOMMENDATIONS FOR AFRICA

Le défi « Le défi est aujourd’hui et-t- il existe depuis longtemps ; il est sous nos yeux lorsque nous sommes témoins au jour le jour de la lutte pour survivre de dizaine de millions d’hommes et de femmes résident dans les régions sous-dites développées et moins développées et émergentes. Le défi est colossal. La réponse doit être donnée dans la perspective de demain à cause du développement incessant des villes en raison de l’explosion des naissances et de l’exode des campagnes qui font envisager des perspectives sombres ».

The above lines have been taken from a Document that we drafted in 1998 in the framework of the UN-FAO Programme “Food in Cities”, http://www.fao.org/fcit/fcit-home/fr/, as Coordinator of the Finance Working Group.

Here we would like to return to the topic in the light of recent trends in the fighting poverty, taking from our accumulated experience in the meantime. We have analysed Africa’s economic trend in the context of the international economy of the past four decades, which we have decoded through the Development Actors’ vision/objectives/growth: at the end of the day, their decisions affected the economic development of the Continent, a place where tough people play a hard game and where contradictions and competition dramatically emerged.

There are many stereotypes about Africa and, in our opinion, the banalities are due to the lack of knowledge of the environment, both natural and human; simply, dealing with the matter, we must find the appropriate key, as happens in places that do not belong to us; but Africa requires a little more than a simple adaptation because we must respect the tradition and the plurality of local cultures more than elsewhere. Africans are proud of tradition and customs.

On the whole, the lack of basic training is more than compensated for by cultural richness, the difference between training and culture being in the behaviour or the way people react. But we must be careful and not confuse collective brutality with respect for human life; the atrocities have been committed (recently in West and Central Africa) for either wrong thinking or conquest of power, and not forget that violent movements have been experienced in past centuries in Europe.

Certainly, the increase of military coup d’état and other conflicts has had a negative impact on the development process. However, for the sake of objectivity, we believe that two factors holding back development have had a major effect, namely the lack of economic inclusion followed by the war in Palestine, which is now spreading to the Middle East.

The failure of inclusive development has greatly hindered the emancipation of African populations from poverty, worse, it has widened the gap between those who hold the wealth and the others (many) who are not yet included in the financial circuits. The war factor, in addition to the consequences on the tragic living conditions of the populations concerned, made the Suez Canal inaccessible, which penalised commercial traffic and thus the economies of Mediterranean and European countries.

According to a World Bank report, for the first time in the century, half of the world’s 75 poorest countries have experienced a growing income gap with richer economies, in a historic reversal of development; and more than half of all IDA-financed countries (75) are located in sub-Saharan Africa.

In our opinion, there hasn’t been a historical inversion, but of a historical problem. The growth rates of African economies have reached high levels, but this aspect shouldn’t be emphasised because they start from low levels of development, which must last over time to have the expected impact.

We are aware that talking about the Continent as a single Unit isn’t appropriate on the grounds that there are 54 States with a very different vision, objectives and utilise various means for taking off; moreover, even in each countryside the way to communicate is a hard exercise. Having said that, the proposed Model of intervention is viable and valid at both regional and country level; in other words, it can be adapted to any landscape and in so doing work out a genuine approach to the market for the Underserved customers matching up innovation and tradition.

According to the Africa Centre for Economic Transformation (ACET) in the period 2000-2020, the progress in human well-being remains highly sensitive to external shocks, and the economy needs to be strengthened and diversified to ensure that progress is not undone by possible economic crises, climate events or epidemics. Only Burkina Faso, Kenya, Malawi and Zambia emerged as individual Countries recording significant progress, as registered by an indicator including income, wage gap, formal employment and women’s participation in the labour market, https://mail.google.com/mail/u/0/#inbox/FMfcgzQVwnVLcRKckMtNTJqTzhzTCptB .

Taking from the Agenda of SDGs and in particular the Objective 1 (end Poverty in all its forms) and Objective 8 (Promote inclusive and sustainable growth), we worked out a new Model to promote growth via business approach re-designing the entire architecture of financial inclusion. Here some basic steps:

– To have in place a country’s appropriate economic policy along with a receptive environment for investments.

– To conjugate together financial and economic inclusion, countries’ inclusive growth being the ultimate goal, as per 2030 UN Agenda for SDGs.

– To establish a National Investment Fund promoted and established by financiers and entrepreneurs really committed to achieve inclusive growth.

– To have Banks, Micro Banks, Investors, Development Agencies, and any suitable provider ready to partner with the Investment Fund and work as a driven belt between the Fund and Entrepreneurs for Start-up and Growth-up Business.

– To have in field a clear and distinctive role among Lenders, Developers and Philanthropists, which have different sources of capitals and distinctive management criteria.

In addition:

1 – To re-design the entire architecture of the approach in favour of poor people and small business as well and shift the paradigm of the financial interventions from the over-indebted economy at a micro and macro level to a real people’s empowerment through jobs creation and opportunities’ promotion.

2 – To have the private investors really involved in the development process either directly sitting in the Development Agencies’ Boardroom or setting up a National Development Fund, to assist the growth of their own communities.

3 – To conjugate together three main Goals of the UN 2030 Agenda for SDGs, namely Goal 1 (End of poverty), Goal 8 (Promote inclusive and sustainable growth) and Goal 17 (Partnership).

4 – To mitigate the excess of financial way to development the detriment of the demand for, namely from the bottom to the top.

5 – To use the financial leverage for sustainable interventions, which is as easy to say as difficult to achieve, because it asks for a revision of the decision-making process and fulfils the eligibility criteria.

6 – To digitalise the services with a product that is sustainable for the providers, affordable for the clients and market transparent: https://www.linkedin.com/pulse/open-letter-fintech-ascanio-graziosi/.

The Model paves the way to put finance providers in the picture of the guidelines provided by the international financial establishment and it has been designed to facilitate the access of the entrepreneurs to the source of capitals, to mitigate the poverty via jobs creation and providing opportunities for people’s better living conditions and business prosperity. The Model aims at promoting growth via business approach, which vision has been inspired by the UN 2030 Agenda for SDGs. The fundamental question is how to manage interventions when dealing with both individual persons and businesses.

With reference to Africa, we found very attractive the Africa Capitalism vision proposed by Mr. Elumelu, a Nigerian tycoon and banker, who, in 2014, in an interview spelled out his vision on what to do to promote African entrepreneurial spirit and how to approach microfinance issues; among other, he said: “It’s all about sustainability”.

It is an economic philosophy based on the belief that the private sector should play a leading role in the continent’s development https://www.tonyelumelufoundation.org/africapitalism .

PROPOSED ACTION

We worked out JAMBO FUND (Swahili greeting) taking inspiration from the Documents/Papers released by the international financial establishment, particularly Basel III Committee.

In addition to, we borrowed from our extensive field experience; in particular, we designed, managed and evaluated Credit Guarantee Fund/ Trust Fund/ Grant Facility/ Revolving Fund in the following Countries: Tunisia, Bosnia, Caribbean (St. Lucia), Romania, Mali, Albania, Netherlands Antilles (Curacao), Malawi, Algeria, Morocco, Ghana and Russia Federation.

1 – Why is the Fund an innovative approach?

JAMBO isn’t business as usual and indeed isn’t just financing but much more: it is a new way to approach the market. We have elaborated on the recommendations of the Establishment, at least how I detected it, to innovate by introducing something new in a mechanism already in use.

2 – Which is the role of the finance providers?

We do have my own idea, of course, but the issue should be discussed together with the Investors in connection with the objective of the FUND: assisting the microcredit sector, which is important for the sound achievement of financial inclusion. The interest of the micro financial providers to cooperate is well beyond the availability of fresh resources, because JAMBO will provide them with advice to review and revise the style of management, to better meet the underserved customers’ needs.

3 – How to start operations?

JAMBO’s horizon is the Continent, but initially, the focus shall be on some Countries: Nigeria, Ghana, Kenya, Morocco, Tunisia, Cameroon, Tanzania and Algeria (to be agreed with Investors). The operations may be advanced by a field survey although it isn’t necessary and indeed it may be overcome with our contacts in the Continents:

We do have in mind to achieve field trips for round-up meetings with the purpose to come back with a significant portfolio. For the time being, the FUND’s model has been partially completed on the grounds that the exercise has to be finalised in agreement with the Investors, who should say a word on topics that belong to them: Institutional and Administrative Arrangements, Organization Structure, Decision Making process, Policy & Procedures. On the matter, we have elaborated some slides for discussion (see online document).

4 – Where shall JAMBO be located?

The office shall be located in Africa to campaign the FUND at inception and then to be close to the Financiers & Borrowers. The FUND shall have a soft structure with a FUND Manager, assisted by a national consultant and a secretary. We have prepared a tentative timetable for establishing the Fund: a month’s time could be the period to complete the job, depending on the way the Investors will speed up the decision’s process.

5 – Which is the private investors’ role?

We proposed the Model because we do believe it is a valid and viable intervention. It will be up to the Private Investors/Institutions/Funding Agencies to appoint a Fund Manager and the other Executives Positions in the Board.

Having conceived and designed the Model and being a field man we will be available to act as a Partner and be involved in running the business.

6 – Why should the Investors subscribe?

The Project-Document starts with the narrative of Africa’s economic development and from this exercise, we drew operational conclusions; justifications and assumptions have been listed in ad hoc paragraphs. The investment shall have economic return and a social impact on the communities as well; also, the investors shall appreciate the return on the image, being the development’s actors for providing opportunities and reducing joblessness. It is worthwhile to note that the African market has been estimated at $ 1.5 billion and JAMBO has been designed to take these opportunities. For more details, click: https://ascaniograziosi.net/2018/04/24/africa-a-continent-of-investment-opportunity-people-objectives-strategy-and-means-2/

The idea behind JAMBO FUND is to establish a Fund in each country to have an identifiable environment to better meet people’s aspirations, interests, objectives to promote/support/finance to both start-up and growth-up activities, which are the backbone of the countries’ economies.

The Model can be applied to any country/region of Africa and in so doing work out a genuine approach to the market for the Underserved customers matching up innovation and tradition. https://www.morebooks.de/store/gb/book/the-gateway-to-africa-inclusive-growth-jambo-fund/isbn/978-620-2-28375-5.

Experience and expertise are a necessary background to drawing it, which afterwards will be a requirement to run the business, which asks for an accumulated daily exposure to evaluate the credit risks.

Dr. Ascanio Graziosi – Owner of Innovative Financial Inclusion Solutions, a financial boutique providing Policy Decision-Makers and Private Clients with advisory services to enable a favourable financial environment and facilitate start-up and growth-up business. Dr Graziosi is a chief player in the arena of economic development. He has collaborated in Sixteen African Countries, out of twenty-four in three Continents, acting as Development Economist on behalf of international funding Agencies (WORLD BANK, FAO, UNDP, WHO, ITALY GVT, DANISH GVT, PRIVATE COMPANIES).

(The views expressed in this article belong only to the author and do not necessarily reflect the editorial policy or views of World Geostrategic Insights).

Top Image Source: Reuters