The trade relations between the Eurasian Economic Union (EAEU) countries and Iran will begin to be preferential on October 27, which will provide Iran with the opportunity to increase the export to the Eurasian market, meanwhile the EAEU countries will open the way to the Indian Ocean and the markets of the Middle East.

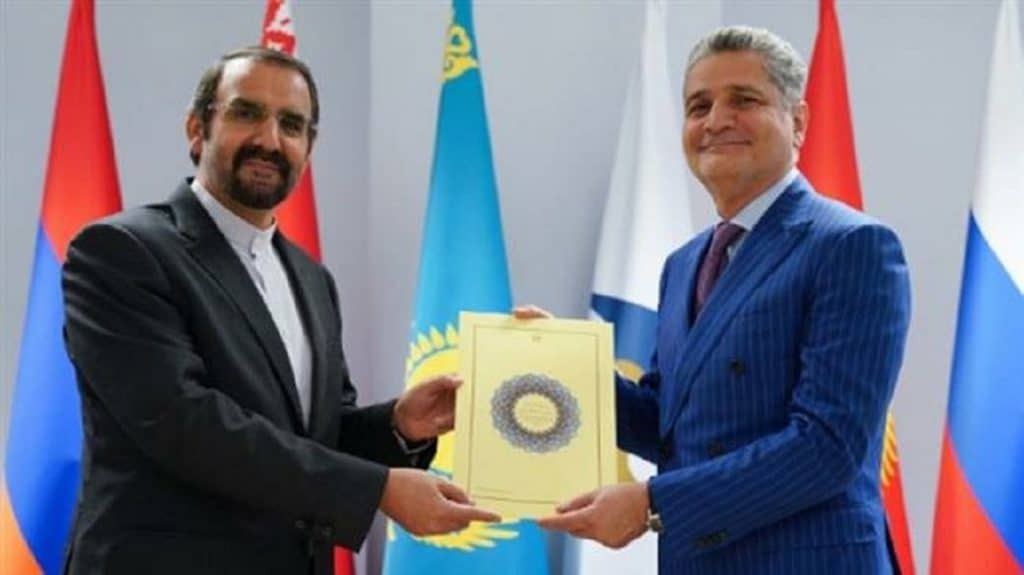

The Chairman of the Board of the Eurasian Economic Commission (EEC), Tigran Sargsyan, and the Ambassador Extraordinary and Plenipotentiary of the Islamic Republic of Iran to the Russian Federation, Mehdi Sanai, on August 29, at the EEC’s headquarters in Moscow, had exchanged the documents needed to complete the formalities for the deal EAEU-Iran coming into force in late October.

In this occasion, Tigran Sargsyan said that “The heads of state of the Eurasian Economic Union stated that the formation of a free trade zone with the Islamic Republic of Iran is a priority in the activities of the Eurasian Economic Commission”. The Ambassador of the Islamic Republic of Iran,Mehdi Sanai, in his response, noted that “For Iran, this is also a very important agreement, which I am sure will bring great benefits to the economy of our country and our people, as well as the people of the EAEU. The negotiations were not easy, but now they have been successfully completed. The agreement is signed and ratified. The result is obvious!”.

Iran became the second country after Vietnam to sigh a trade deal with the EAEU, with the only difference being that the agreement with Iran is designed for only 3 years, and it will cover 50% of trade between Iran and the EAEU, which is 502 Iranian goods and 864 goods from the Union countries temporary nature is explained, first of all, by the fact that the parties could not immediately reset import tariffs. However, zeroing the import tariff will be discussed during future negotiations on the creation of a full-format free trade zone, which should start one year after the start of the temporary free trade zone. The next three years should help to identify both the advantages and disadvantages that will raise during the implementation of the deal. And the pros and cons will be taken into account in defining a full-format agreement that will be concluded by early 2022.

The deal may represent a major breakthrough for Iran’s trade. It may help Tehran to increase its revenues from non-oil export at the time of increased US sanctions. Abbas Ali Kadkhodayi, the spokesman of Iran’s Guardian Council, which oversees government’s accession to regional and international treaties, said that:“The Guardian Council viewed the deal as a major component of Iran’s strategy to forge better relations with countries in the East. This agreement will be a substantial help to Iran’s economic development and to defeat sanctions using diplomacy and the potential of international and regional organizations”.

EAEU is a major regional organization that provides for free movement of goods, services, capital and labor within the Republic of Armenia, the Republic of Belarus, the Republic of Kazakhstan, the Kyrgyz Republic and the Russian Federation. Since its inception five years ago, the EAEU has managed to massively expand its trade with major economies in the Middle East and in East Asia. The market of the EAEU countries at purchasing power is estimated at 4 trillion. dollars with 180 million consumers, with a combined GDP of about $2.2 trillion, $ 3.1 trillion of industrial products, and $ 877 billion trade with non-member countries, equal to 7.3 percent of world export and 3.2 percent of world import.

Iran, a non-member to the World Trade Organization (WTO), can enjoy the benefits of trading on WTO terms with the EAEU countries. Iran business companies will have the opportunities to occupy existing niches in the EAEU market, facilitating the efforts of Iran to diversify its economy. Iran can supply goods and products to the EAEU markets through the land borders of the Republic of Armenia as well as sea borders of the Russian Federation and Kazakhstan. At the same time, EAEU countries will have easier access to the Iranian market with its 80 million consumers and a fairly large stratum of the middle class should also bring economic benefits. According to the plan, in the initial stage of establishing a free trade zone, Iran will export about 350 kinds of goods to the Eurasian Economic Union and import 180 kinds of goods.

According to the president of the joint Iranian-Russian Chamber of Commerce Hadi Tizkhush Taban, the agreement will allow the EAEU and Iran to increase trade to $ 10 billion.

In a special way Armenia wish to play a significant role in the implementation of this agreement, as a direct neighbor and long-standing trade partner of Iran. It plans to increase supplies of batteries, pharmaceuticals and knitwear, mineral waters, meat products, confectionery, and also to become a transit country for the export of Iranian products to the EAEU states. Kazakhstan, using the reduction of the customs tariff, plans to significantly increase the export of its agricultural products to the Iranian market.. As for Russia, it intends to increase supplies across the entire range of products for which the Iranian side provides reduced customs tariffs.

So, the interim agreement with Iran is an experimental field for the EAEU in the context of considering the future expansion of the Eurasian economic space. Meanwhile for Iran it is a search for new markets for products and an attempt to minimize the effect of sanctions, and the departure of most European companies from the Iranian market. But the implementation of the deal may face several challenges. First, the Iran’s financial problems, which are likely to worsen as a result of continued US pressure on Iranian exports of oil and petrochemicals, mining and steel industries. This problem may in part resolved with loans from Moscow to Iran, but Tehran could risk to pay a political price for that.

Another challenge for companies from the EAEU countries can be the definition of safe settlement mechanisms, since Iran is disconnected from SWIFT, and the Americans monitor any transactions through the dollar system, and if there are transactions with Iran, they may introduce penalties against participating companies and their management. So far, the transition to national currencies is being considered as an option, but its weakness is the high inflation of the Iranian rial. Following the introduction of U.S. sanctions in 2018, inflation in Iran rose from 9.64% in 2017 to 31.17%. According to the IMF forecast, in 2019 it should be 37.2%. Also Tehran, due the US sanctions, is trying to minimize the import of those goods that can be produced domestically. In 2018, the Iranian parliament introduced a ban on the import of 1399 types of goods, which are also produced in Iran in volumes sufficient to satisfy domestic consumption

However, despite the presence of a number of important challenges,, the free trade agreement between Iran and EAEU may have deep economic and geopolitical repercussion in the Middle East, in the Caucasus, in the Caspian region and South Asia,

From a strategic point of view, Moscow can use the agreement as a kind of springboard to implement a more fundamental policy of including Iran in the newly created Russian technological zone. The current situation, which is characterized by the actual closure of Iran’s access to Western technology, offers Moscow promising opportunities. It can further strengthen its position in Iran’s nuclear energy and in the passenger aircraft market. Russia may also take a leading position in the market for the supply of high-tech weapons to Iran. It has already delivered the S-300 air defense system for the Iranian army in 2016, and recently the topic has been circulating in the media about the possible delivery of an advanced Russian S-400 air defense system capable of dramatically strengthening Iran’s air defense system.

Also China has very important interests in Iran and the Caucasus and Central and South Asia. China is the largest importer of Iranian oil, and the fullness of the Iranian budget will directly depend on its position with regard to anti-Iranian oil sanctions. Recentlly Iranian Foreign Minister Mohammad Javad Zarif met with his Chinese counterpart, Wang Yi, to discuss a further energy and infrastructure deal between the two countries. Undoubtedly, China’s investments in Iran allow it to exert its influence on Iranian foreign policy.

But it is also worth to note thart in May 2018, China and the Eurasian Union signed an economic and trade cooperation agreement. Meanwhile, Russian President Vladimir Putin said that China is a strategic partner of the Eurasian Economic Union (EAEU) and that the construction of the Eurasian Economic Union should be linked to the construction of the “Silk Road Economic Belt”.

So, it is likely that Beijing will try to fit into the Iran- EAEU agreement by connecting it to its initiative “One belt – one way”. This could bring new unpredictable developments.

Image Credit: Eurasian Economic Commission (EEC)