Word Geostrategic Insights interview with Ascanio Graziosi on the constraints of the current global financial system for Africa, the viability of new models and approaches to deal with investment financing, and the prospects for economic development and investment in Africa.

Dr. Ascanio Graziosi is the Owner of Innovative Financial Inclusion Solutions, a financial boutique providing Policy Decision-Makers and Private Clients with advisory services to enable a favourable financial environment and facilitate start-up and growth-up business. Dr Graziosi is a chief player in the arena of economic development. He has collaborated in Sixteen African Countries, out of twenty-four in three Continents, acting as Development Economist on behalf of international funding Agencies (WORLD BANK, FAO, UNDP, WHO, ITALY GVT, DANISH GVT, PRIVATE COMPANIES).

Q1 – Speaking at a high-level panel discussion – Towards an equitable international financial architecture – at the 78th United Nations General Assembly, last September 2023, African Development Bank (AfDB) President Akinwumi Adesina said that the global financial architecture constraints Africa’s development because it does not provide the resources needed to enable Africa to achieve its growth and development priorities. The AfDB President recommended five ways for a more equitable and beneficial global financial architecture for Africa: – multilateral development banks should employ risk mitigation instruments, – simplify the architecture of global climate finance, – change their business models to provide greater volumes of concessional finance to African countries, – there should be a better capitalization of multilateral development banks, and – a portion of IMF Special Drawing Rights (SDRs) from SDR donor countries should be channelled through the multilateral development banks.

You have vast field experience on the African continent and a deep understanding of development finance issues. What is your view on Dr Adesina’s remarks and proposals?

A1 – We do agree with the AfDB’s President when he said that the global finance architecture constrains Africa’s development and we would like to add some more to the suggested five ways, mainly referring to our field experience in sixteen African Countries acting as Economist on behalf of Funding Agencies.

Although the resources weren’t and aren’t equal to the task that is immeasurable, a key reason is on the unfitted inclusive development’s approach.

It should be said that in the past the AfDB has highlighted the problem and in 2019 based on the results of a market research listed five gaps hampering the achievement of a sustainable growth of the emerging economies located in the Continent. The Bank hasn’t been alone outlining the importance of re-thinking the course of action and OECD, World Bank, UNDP, and other Agencies dealt with the issues.

The interventions of the above institutions haven’t produced real wealth but virtual affluence, being too much finance oriented to the detriment of the real economy. In the past and recently, we widely discussed the matter pointing out the poor involvement of the African capitalists, which is a very key issue.

To understand the development finance’s dynamics in the Continent, it should be noted that the expected outcome of whatsoever intervention in any of the three segments Enterprise Development, Income Generating Activities, Food aid (Box below) shall vary in relation of the relative importance (weight) of the interests, objectives, positions, expectations of the Development Actors.

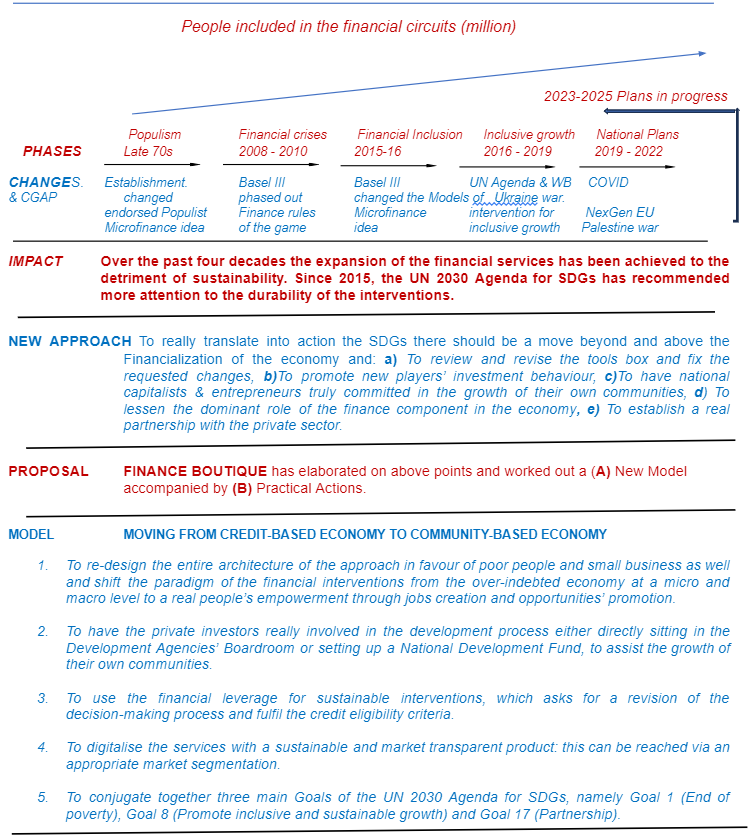

The Figure 1 below visualises the position of the players and the way their decisions affect the financial trend; in other words, the economic cycles are originated by the options taken by the decision-makers.

Investment Performance equation = F (ED; IGA; FA)

Who are and what are the development Decision-Makers? – Finance Providers & Donors, delivering suitable/unsuitable response in managing the change in reaction to emerging market conditions – Governments, providing/non allowing an enabling environment – Management Unit, competence/incompetence in reconciling interests, objectives, demand, and expectations of the Players – Borrowers, submitting viable/unviable requests for financing.

From the Figure1 it can be assumed the following: the Governments aim at reaching the most outreach in terms of population/areas; the financial Providers’ objective is a proper allocation of the resources and expanding the market share. On the other hand, the Borrowers have to submit viable requests and the Team in the field have to apply the best practice.

As a result, a welding point shall be found out in a continuing negotiation among the Actors to reach an acceptable agreement. Moreover, From Figure 1. can be perceived as an important role played by the Actors: their decisions shape and influence the economic cycles.

Figure 1 – Connecting the dots of the financial narrative

Back to the question, more than “to revisit the global financial architecture” and “to reshape both national and international financial systems … “, it could be more appropriate having Stakeholders/Players rethinking the approach to the market.

Just a few words to put the reader in the discussion picture. Further to the global financial crisis in 2008, the Bank for International Settlements (Basel III Committee) issued a series of documents to regulate and supervise the international financial transactions, which have marked a discontinuity at macro finance and micro lending as well.

A decisive step was made in 2010 when Basel III Committee issued the guidelines for the micro microfinance activities and then (2015-2016) the UN Agenda SDGs, Basel III and CGAP phased out the wrong way of doing micro credit and gave a casting position to the sustainability factor. In 2016 the UN published the Agenda 2030 and recommended sustainable interventions.

We elaborated on the above documentation and concluded that to reset financial capitalism there isn’t a need to add new rules to the finance game but to change the approach to the market and environment; in a word, the development Actors should revise their investment behaviour. At the end of the day, the responsible people’s decisions make the difference.

Why don’t African Capitalists invest in their region? The answer is very intriguing and requires going back to the 80s of last century, when the Establishment supported the idea of retail credit and microfinance as a way for mitigating poverty and promoting sound economic growth. As it is well-known, after three decades full of contradictions along with defaulters’ dramatic situations, the Financial Establishment withdrew the endorsement to the easy going to credit and at the 17th Microcredit Conference (22/09/2014 in Merida, Mexico), Yunus and Populists admitted the failure and said that the concept was poorly applied.

The true is that they assigned to the lender the task – fight poverty – that is a government’s duty and mystified the concept of credit that means confidence, actually providing the licence to default to ineligible borrowers; more important, the Populists fail to advise that credit must be managed by Professionals and asks for competence and skills above the ground: one can’t become lender downloading credit packages as it happened last century.

Finally, in 2018 the World Bank stated, “African investors remain risk-averse” and ” … the funding requests lack speaking the language required for investment”. Very important declaration, indeed. The question is twofold: Which is the reason for capitalists’ risk-adverse? Why don’t they invest in their regions? Our position on the matter is in the answer to the following question.

Q2 – In your book “The Theory of Change Applied to Finance for Development” published in 2022, you elaborate a methodological approach, inspired by the United Nations 2030 Agenda, and practical actions to minimise the dominant role of finance in the economy and engage capitalists in the real economy, according to the World Bank Group’s development framework.

Can you summarise here the main outlines of your theory, the approach you envision for addressing investment finance, and how it could be applied in Africa?

A2 – We will try to summarise the theory explaining from where it comes from, on the grounds that it could be uncommunicative without an informative background.

The research has originated from the question: which are the reasons behind the poor investments? Only a new analysis can sort out the impasse. We did it. To understand what has been going on in the development finance’s trend, we have filled the dots of the narrative and connected them. In short, the Model has to be read as a logical consequence of the reasoning developed in Figure 1. Here we can’t detail this exercise that can be understood from the book you mentioned.

From the analysis emerged the dominant role of finance called financialization of the economy that produced virtual affluence instead of real wealth and therefore not suitable to leverage the sustainable growth.

Consequently, we do think that the Big Financial Players should rethink the course of action, on the grounds that they didn’t do so much to implement the SDGs of UN Agenda, which provided a new vision and paved the way to achieve the 17 goals; in short, the International Financial Agencies didn’t revise their “tools box” and the approach hasn’t been in tune with the requested changes.

How have the big financial players worked so far? They issued, implemented, and measured the changes in isolation: see World Bank with its Affiliates (IFC) and House Organs (CGAP).

We do think that there is a need to include more Stakeholders in the decision-making process; practically, it is necessary to give access to other development Actors: private capitalists, investors, representatives of local communities, to better understand and respond to the demand of the communities. Why? Because the real meaning of financial inclusion is to include each one and everybody, sustainability being the central core of the interventions.

Owing to the fact that the existent paradigm can’t be changed, there isn’t a choice but to play with the cards distributed by the Big Financial Players and then elaborate a Model of intervention.

Accordingly, we have assumed the Theory of Change applied to the Finance for Development as a process of a continuing negotiation among the Development Actors, who have different interests/aspirations/objectives and expectations in pursuing a development goal with the prevalent models at that moment in time.

Over the past decades the Finance component has governed the world of the business, and this is quite understandable bearing in mind that the financial leverage is important and sometimes essential for whatsoever activity. But the question is: which finance? Financialization with unsustainable interventions? Absolutely not.

Currently, Finance’ dominant position is no longer accepted as a constant of the development’s equation and therefore the related financial algorithm should be reshaped to achieve the objectives.

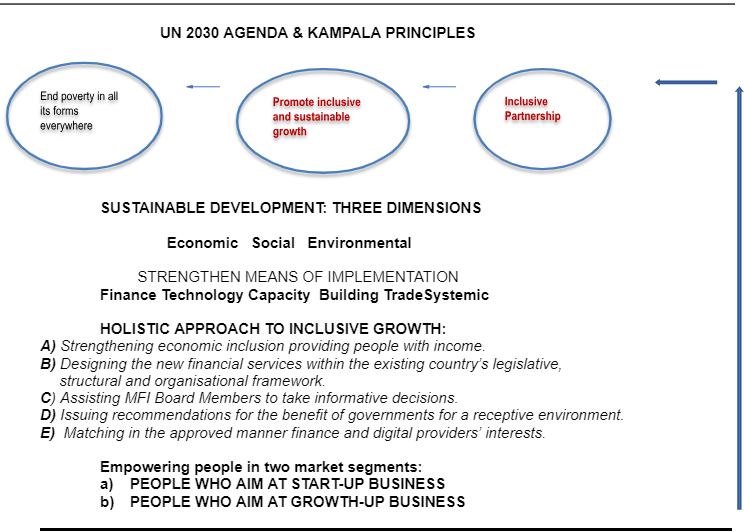

We have worked out a Model of intervention to mitigate the unsuitable development paradigm and proposed a Business Approach via jobs creation and supporting opportunities, for people’s better living conditions, taking inspiration from the UN 2030 Agenda for SDGs.

FINANCING MODEL, MOVING FROM CREDIT-BASED ECONOMY TO COMMUNITY-BASED ECONOMY

Two steps: To re-design the entire architecture of the approach in favour of poor people and small business as well, shifting the development paradigm from the over-indebted economy to people’s empowerment through jobs creation and opportunities’ promotion.

The Model has been proposed the first time seven years ago in our eBook FINANCIAL INCLUSION with the subtitle “give people a job, not a loan” well synthesise the intent to revise the developing finance’s approach. We have worked out a conceptual framework that has been visualised in Figure 2. Could it be a reference point for designing a Model for Africa? The answer is positive, on condition to stay away from the danger of considering Africa as a sole entity. In short, the best way could be to translate the Model referring either to a homogenous regional political-socio-economic setting or to country by country. From the geopolitical background it can be made a distinction as follows: North Africa Region, Sahel Countries, West Africa, East Africa, Equatorial Africa, Southern Africa and treat separately the Republic of South Africa; Nigeria also deserves a distinguo. Again, as a whole the effects of the economic cycles (Covid, Crisis, etc.) have been asymmetric in the Continent and unequal when referred to above mentioned areas.

Currently, there is a wide consensus ranging from Academics to Practitioners who endorse the idea to have the countries’ inclusive growth where each one and every Actor should be committed under the flag of Private and Public Partnership.

Merging the voluminous narrative on development finance with our field experience, we have concluded that to properly achieve the Poverty Mission and Businesses’ demand, the Development Actors should: 1) to reinstate the correct concept of financial leverage, 2) to lessen the dominant role of finance in the economy, 3) to focus on jobs creation and people empowerment and 4) move from the Credit-based economy to Community-based economy (see below our Proposal).

We have integrated what the UN Agenda has recommended, which is centred around three fundamental pillars: sustainability, participation, and inclusion.In this comprehension, the Develop Finance’s Actors should be pro-business and gear up towards job creation and opportunities’ promotion. It is a question of getting back into play and making progress and projecting the future learning from the weaknesses and mistakes of the past. In a word, there is a need to reconsider poverty in terms of sustainable growth and transformation of economies.

Figure 2 – The inclusive growth via business approach

Finally, the question is how to bring together Financiers and Entrepreneurs in the framework of a fruitful cooperation between Governments and Private sector, as recommended by the World Bank. The answer to the following question explains our position.

Q3 – The African Development Bank in its report, “Africa’s macroeconomic performance and prospects,” predicts that Africa’s economic growth will outpace that of the rest of the world in 2023-2024, with real gross domestic product (GDP) increasing by about 4 percent on average. Africa’s five best-performing economies in the pre-coronavirus pandemic period (Rwanda, Côte d’Ivoire, Benin, Ethiopia, Tanzania) are expected to grow by an average of more than 5.5 percent over the 2023-2024 period and regain their place among the world’s 10 fastest-growing economies. However, elements of global and regional risk remain, prompting some caution: rising food and energy prices, tightening global financial conditions and the resulting increase in domestic debt service costs, climate change, with its adverse effects on food supply, and political instability. In general, it seems that Africa, despite its real enduring problems as well as false misconceptions is now on the verge of an incredible transformation toward a future full of endless possibilities.

What is your opinion? How do you see the future of Africa and the prospects for investment in this continent?

A3 – The prospects for investment in the continent are in the hands of African people and to some extent in the strategies worked out by the European Union to assist Africa to finally take off. We do say that Africa’s future isn’t looming, on conditions that the African capitalists take the lead and invest in their own Regions; moreover, Africans should learn from what went wrong in the past.

We may recall the journey of Mr Clinton, President of the USA in Africa (2013) and the promise to budget some US $ 2.5 billion to invest. To our knowledge, any impact hasn’t been noticed.

A year later, Mr.Elumelu – a Nigerian tycoon and banker – in an interview spelled out his vision on what to do and promote African entrepreneurial spirit: “There are some areas — flood disasters, for instance — where you must give charity. But I think the charity approach to solving other issues must be reassessed”. It’s catalytic philanthropy”. We subscribe to the sentence.

Dr Akinwumi Adesina is aware of the reasons hampering the investment in the Continent and listed them. In our view, political instability has a casting position, bearing in mind that investors dislike uncertainty, and future insecurity as well. The reports from the recent events in West Africa, namely Mali, Niger, Guinea Conakry, Nigeria, where coups d’état upset the political scenario, are, unfortunately, examples that hamper investments.

We would like to mention what Samia Suluhu, the President of the United Republic of Tanzania, said at the opening of the 23rd WTTC Global Summit): “Africa should tell its own stories in its own terms and set up positive narratives about our continent. We cannot afford to continue remaining silent in this era of fake news. … African governments must translate their words into action by investing in country branding and positioning. It remains a significant challenge to persuade policymakers to allocate funds for campaigns led by African creatives and communication professionals, who have the ability to share our stories with a global audience. We have tried. Only a handful of nations get it. We can do better!”

We proposed two Practical ways to apply the Paradigm in Africa.

Option A – National Capitalists Join Development Schemes

On paper the best way to face the situation is to take private financiers & entrepreneurs onboard, learning by doing being the appropriate way to disseminate the language required for the investments.

Usually, the development funds are established further to a decision taken by either development agencies or governments, or private businessmen with the purpose to have an instrument to leverage the economic activities located in the Continent. In this situation the related decision-making process is from top to bottom.

Our proposal does intend to reverse the process and have national investors, financiers, representatives of the communities in the Boardroom apporting both fresh financial resources & ideas, acting as a chief actor who commit themselves to support the economies of their own countries/regions.

Example. International Finance Corporation (World Bank Group focusing on the private sector’s investment) should set up a Fund in each of the twenty MENA Countries stretching from Iran to Morocco using a slice of the $ 2 billion as a seed capital and calling up national capitalists and entrepreneurs to act as Shareholders really committed to make it happens both start-up and growth-up activities, which are the backbone of the countries’ economies.

Under the circumstances IFC could act as a Facilitator and advisory provider, its presence being a guarantee of the operation.

This does mean: (1) To take down the paradigm off the financial interventions from the over-indebted economy at a micro and macro level. (2) To have private investors really involved in the development process. (3) To use the financial leverage for sustainable interventions. (4) To digitalize the services with a sustainable and price transparent product. How could it be applied in Africa?

However, we do believe that the conditions of having private capitalists in a boardroom (Option A) are unlikely to be fulfilled, because under the circumstances letting somebody in the boardroom means to share the power and this rarely happen; the ultimate goal of financiers at all levels – from WB & IMF till the lender around the corner – besides making profit from investments, is to influence the debtors’ budget and therefore interfere in their decision-making process.

Option B – National capitalists establish their own Fund

In such a situation there shouldn’t be any other option, but the national capitalists establishing a National Risky Fund: it is up to them to take on charge the future of communities and in so doing minimise the jobless’ migration to Europe.

The financial resources shouldn’t be a problem according to the research carried out on the matter, which have estimated a significant amount of private capital that could be invested.

We do believe that the Capitalists should be the first ones to move on and invest in their own Regions/Countries. On the matter, in 2020 we sent an OPEN LETTER TO AFRICAN CAPITALISTS urging them to invest, following what the Nigerian banker & tycoon Elumelu has been repeating again and again: “Years from now, I believe that my legacy will not be defined by my material successes … but by this unwavering commitment to developing and strengthening African entrepreneurship. This is what will stand the test of time”.

We decidedly agree that Africa is now on the verge of an incredible transformation toward a future full of endless possibilities. It is sufficient to have a look at the demographic trend to catch the development’s challenges.

According to UN, Africa’s population will blow up and the unemployment rate among youngsters will continue to be alarming: currently, the population is about three-time (1.4 billion) the EU population and shall double by the year 2050. The importance and the implications of the above data don’t need to be emphasised also on the grounds of the low natality rate, particular in Italy. Can Europe, better the EU, neglect such evidence? Can the EU Commission ignore the challenge?

Nowadays, Mrs Ursula von der Leyen, president of EU Commission budgeted € 300 billion for promoting the EU Global Gateway, half of amount to be allocated in Africa: we participated to the Meeting held in Rome last October 2023 under the sponsorship of European Council on Foreign Relations, Africa & Affari, Confindustria and others. A lot has been said, but what to do is still to be defined along with the Piano Mattei of the Italian Government, whose details are unknown.

We are confident that, finally, the massive amount of resources shall be invested in the Continent in respect of viability and sustainability factors.